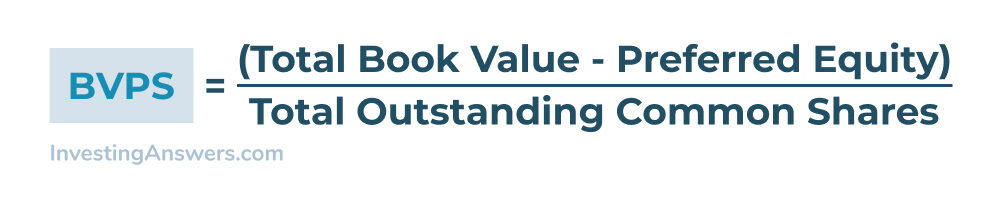

Book value per share is the portion of a company’s equity that’s attributed to each share of common stock if the company gets liquidated. It’s a measure of what shareholders would theoretically get if they sold all of the assets of the company and 9 ways to identify a great business idea paid off all of its liabilities. BVPS relies on the historical costs of assets rather than their current market values. This approach can lead to significant discrepancies between the book value and the actual market value of a company’s assets.

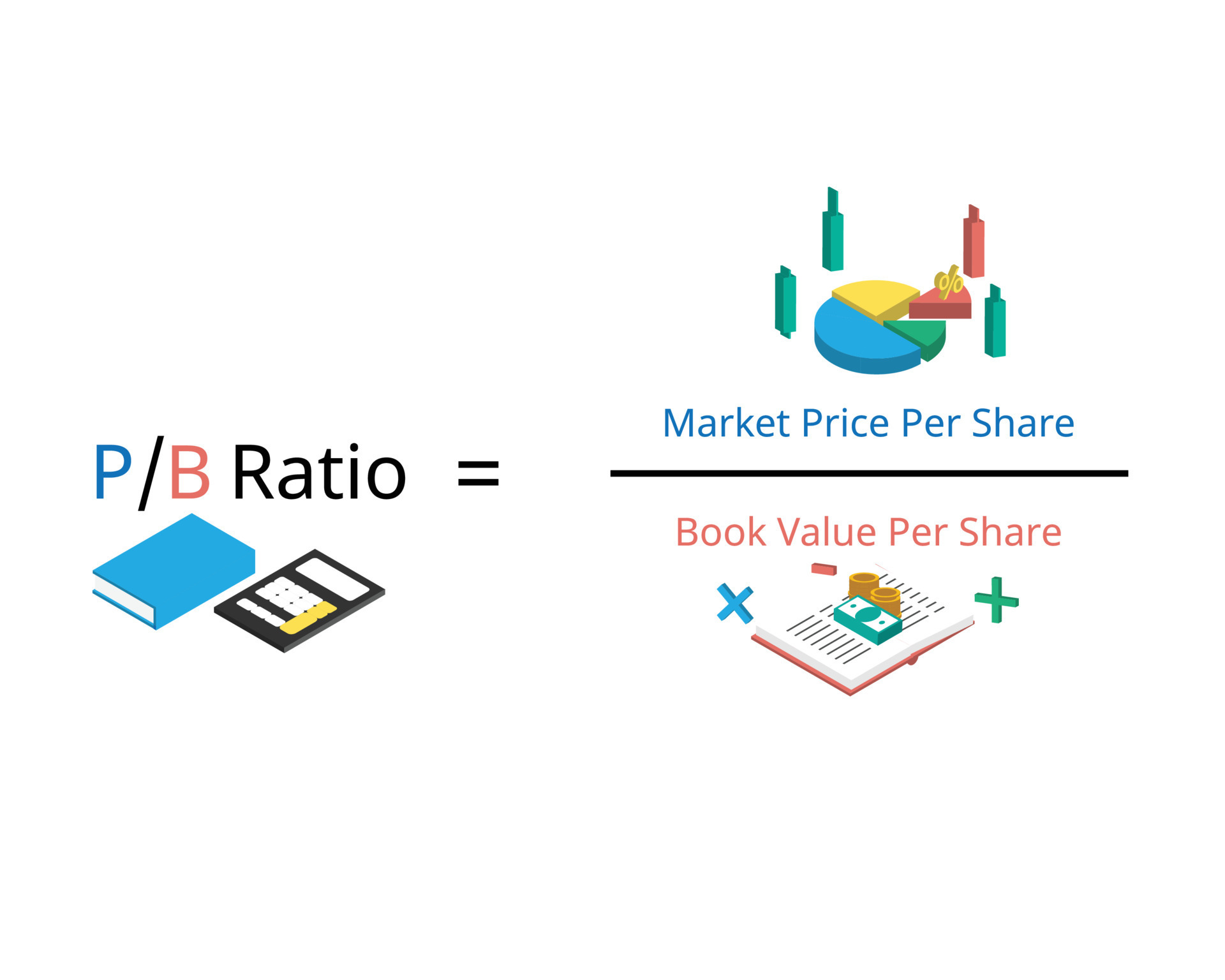

Price-to-Book (P/B) Ratio

For example, if a company has a total asset balance of $40mm and liabilities of $25mm, then the book value of equity (BVE) is $15mm. As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from the latest financial report (e.g. 10-K, 10-Q). If the market price for a share is higher than the BVPS, then the stock may be seen as overvalued.

Formula and Calculation of the Price-to-Book (P/B) Ratio

Earnings per share would be the net income that common shareholders would receive per share (company’s net profits divided by outstanding common shares). The figure that represents book value is the sum of all of the line item amounts in the shareholders’ equity section on a company’s balance sheet. As noted above, another way to calculate book value is to subtract a business’ total liabilities from its total assets.

How to Calculate BVPS?

- It also may not fully account for workers’ skills, human capital, and future profits and growth.

- The book value of a company is the difference between that company’s total assets and total liabilities, and not its share price in the market.

- If XYZ saves 300,000 in liabilities by using that money, the company’s stock price rises.

- As a result, investors must first determine the market capitalisation of a company by multiplying the current market price of its stocks by the total number of outstanding shares.

- Total annual return is considered by a number of analysts to be a better, more accurate gauge of a mutual fund’s performance, but the NAV is still used as a handy interim evaluation tool.

- Enterprise value, or firm value, market value, market capitalization, and other methods may be used in different circumstances or compared to one another for contrast.

Book value per share is just one of the methods for comparison in valuing of a company. Enterprise value, or firm value, market value, market capitalization, and other methods may be used in different circumstances or compared to one another for contrast. For example, enterprise value would look at the market value of the company’s equity plus its debt, whereas book value per share only looks at the equity on the balance sheet. Conceptually, book value per share is similar to net worth, meaning it is assets minus debt, and may be looked at as though what would occur if operations were to cease.

To calculate book value per share, simply divide a company’s total common equity by the number of shares outstanding. For example, if a company has total common equity of $1,000,000 and 1,000,000 shares outstanding, then its book value per share would be $1. Another way to increase BVPS is for a company to repurchase common stock from shareholders. Assume XYZ repurchases 200,000 shares of stock, and 800,000 shares remain outstanding.

However, if advertising efforts enhance the image of a company’s products, the company can charge premium prices and create brand value. Market demand may increase the stock price, which results in a large divergence between the market and book values per share. Should the company dissolve, the book value per common share indicates the dollar value remaining for common shareholders after all assets are liquidated and all creditors are paid.

Because book value per share only considers the book value, it fails to incorporate other intangible factors that may increase the market value of a company’s shares, even upon liquidation. For instance, banks or high-tech software companies often have very little tangible assets relative to their intellectual property and human capital (labor force). For instance, consider a company’s brand value, which is built through a series of marketing campaigns. U.S. generally accepted accounting principles (GAAP) require marketing costs to be expensed immediately, reducing the book value per share.

5paisa will not be responsible for the investment decisions taken by the clients. On the other hand, if a company with outdated equipment has consistently put off repairs, those repairs will eat into profits at some future date. This tells you something about book value as well as the character of the company and its management.